Garmin DCF Model

- The IB Brief

- Jul 10, 2025

- 2 min read

It had been a while since I’ve done a DCF analysis so I thought it would be a good idea to brush up on my skills. I’m very into running now, so I picked a fitness related company, Garmin. While I currently have an Apple Watch on my left wrist, I’m interested in picking up a new watch for my runs so why not learn more about the organisation behind the gift I want under my tree this Christmas!

I followed the same blueprint I did for my Coca Cola analysis which you can find here.Again, I would like to credit this method to YouTube videos created by The Plain Bagel and Financeable Training who both make this concept very easy to understand. Here’s the same method I adhered to. For those who are unaware, the DCF model is valuation method which projects future cash flows and uses them to estimate a company’s intrinsic value.

1) Forecast Free Cash Flow FCF

2) Calculate WACC

3) Estimate Terminal Value

4) Discount back to calculate enterprise value.

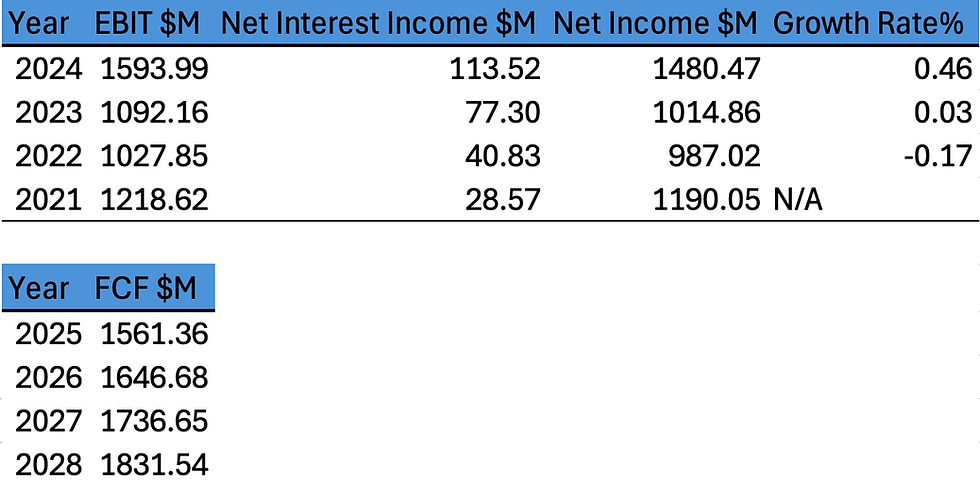

1) Forecast Free Cash Flow

To do this, I calculated the growth rate from previous years (using net income) then applied that to project the next 5 years. This is simpler than industry standard but for the purposes of this article it fits the bill. My data is taken from Yahoo!Finance. My growth rate is very optimistic at above 10%. However, there has been a big surge in the fitness and fitness tech industry post Covid so perhaps it isn’t too outlandish.

2) Calculate WACC

Equation 1: WACC Formula

The following WACC inputs were sourced from publicly available financial data.

KD = 0% (Cost of debt)

t = 11.46% (Corporate tax rate)

D = $0.11B (Debt market value)

E = $39.86B (Equity market value)

KE = 7.69% (Cost of equity)

It’s very interesting to note Garmin’s model runs on having 0 long term debt which is facilitated by its large cash reserves. While this does significantly simplify the equation, we come out with an estimated WACC of 7.67%.

3) Estimate Terminal Value

FCF final year = $1.83B

r= 7.67% Discount rate

g= 2.44% Growth rate

Using data from Trading Economics, I calculated a g of 2.44%. g is typically the same as the growth rate of the country the company is based in. This resulted in a terminal value of $38.73B.

4) Discount back to calculate enterprise value.

This gives us an enterprise value of $30.40B.

If you enjoyed this, check out the rest of my stuff here!

Comments